Gold: “comes in from the cold”

Recent equity market volatility has helped gold overcome its reputational issues. The yellow metal peaked at just over $1900 / oz in September 2011 but has spent most of the last four years between $1050-$1300 / oz. Recent gold buying is a function of:-

A) Heightened global equity and currency market volatility

B) Reduced expectations for Federal Reserve rate hikes over 2016

C) Increased perception of US/UK political risks over 2016 necessitating a liquid global asset denominated in USD and benefiting from “safe haven” status (albeit with a tarnished reputation)

What precisely has changed?

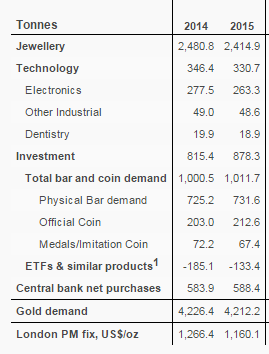

According to World Gold Council (Link) data gold demand in Q4 2015 rose 4% to 1,117 tonnes. This suggests improving supply/ demand fundamentals.

Supply of the yellow metal:-

A) Annual gold mine production up 1% (its slowest rate since 2008) whilst recycling activity dropped to multi-year lows during the 2012-15 down cycle.

Demand for the yellow metal:-

A) Consumer demand remained resilient over Q4 (US +6%, India +6%, China +3%, East Asia +5%) balanced out lower demand from EU -7%, Middle East -18% and Russia -26%.

B) Overall as World Gold Council 2015 data shows, the commodit demand was resilient and almost unchanged (-0.3%) suggesting buyers kept buying and were incentivised by the lower average price (-$106.30 / oz) over 2015.

Source; World-Gold Council

Chronic product oversupply/ dependence on China is a key factor for base metals. But this is not the case for gold (supply +1%/ demand -0.3%) over 2015. In 2016 we expect demand growth to continue the Q4 trend and outstrip supply growth.